Every business has two major goals, that are users and their money. And though all customers are important, they have different value for the business. When building a marketing strategy, you need to know how one customer differs from another. LTV calculation will be of use. Here we explain what this indicator is, how to calculate it correctly, and what you need to do to multiply it.

What is LTV?

LTV stands for Lifetime Value. It means the lifetime value of a user or customer. In marketing, this is an indicator of company’s profit from a particular customer (or user) for the entire period of interaction. LTV is a predictive indicator. You can use it to forecast how much money a customer is going to bring you.

The indicator includes funds spent on attracting, engaging, and retaining the user and, most importantly, the income from them.

Why do you need to calculate it?

Any business should be profitable. Things are bad when the attraction of new customers is more expensive than the profit from them. The business spends more than it receives, so it goes bust after some time. LTV shows the profit from a customer for the entire period of work. The indicator helps establish the difference between income and expenses and warns of danger if this difference is negative.

This is the main, but not the only advantage of LTV calculation. The indicator will be useful for solving various problems and will help you build a competent business development strategy.

- On the basis of LTV, you can calculate expenses for attracting new customers. The higher the indicator is, the larger advertising budgets you can plan. For a robust business growth, LTV is believed to be three times higher than the cost of attracting one new customer.

- Lifetime Value makes it convenient to segment the target audience and determine the most loyal and profitable one. This knowledge will help build targeting and create a balanced loyalty program while focusing more on the most generous customers.

- LTV will be useful for analyzing the channels of attraction. By studying this indicator, you can see where loyal customers come from and pay precise attention to the most profitable sources.

- It is always cheaper to retain users than to attract new ones. LTV will timely show you that customers leave after a single purchase and will help adjust the strategy of their retention. Competent support that can restore and strengthen relationships with users will facilitate the process.

- LTV knowledge is necessary to forecast profit for the next month, quarter, or year.

What is the difference between LT and LTV?

You can find two similar indicators, LT and LTV, in marketing research. Let us understand how they are related and different.

- LT stands for Lifetime. This is a time when a customer uses your products or services. The duration of this period is directly influenced by the quality of communication between the customer and the company via chatbots, messengers, and support operators.

- LTV stands for Lifetime Value. This is money the customer has paid you during the period of your interaction.

Remember accurately and not confuse: LT is time and LTV is money.

How to calculate LTV correctly

There are several options of how to calculate LTV. Before we describe them, here are some preliminary remarks to help you select the method that suits you:

- The options differ in calculation complexity, and there is even an integral in one of the formulas.

- For some calculations you have to know additional metrics to substitute them into the formula. These options will be suitable if you have a good analytics system, collect data regularly, and calculate business metrics.

- The more complex the formula is, the more accurate the indicators are.

- Simple formulas are enough for a small business. Larger companies have to pay more attention to calculations and use complex forecasting methods.

Now to the formulas. For clarity, let us take a fictional company Mair, that opened a small public boxing gym.

Option 1. The simplest one

Our gym has just opened and has been operating for only six months. Let us calculate the LTV of its customers for this period. Let us use the formula:

Let’s say we have had 60 athletes working out for 6 months. They have paid €1,000 for various services. The formula gives us LTV = €150.

The advantage of this method is its simplicity. You can quickly calculate, but the figures are approximate. It is not suitable for serious planning. Moreover, it does not take into account new customers who have not spent money yet. For this to happen, our gym needs an official messenger, e.g. WhatsApp, to quickly communicate with customers.

Option 2. Medium difficulty

Time flows, popularity grows, and more and more people want to box. The gym has introduced additional services, and the previous formula has become too simple. Let us turn to a more advanced method:

We have already mentioned that Lifetime or LT is the time a customer works out in our gym and uses various services. ARPU stands for Average Revenue Per User or average income per boxer for a certain period. In order to calculate this indicator, you need to divide the total income for a certain period (e.g. a month) by the number of customers for that month.

Let’s say a month of training in the gym costs €150. People usually buy passes for several months, three or six, to save on monthly payments. After multiplying these metrics, we receive a quarter LTV of €450 and a six-months LTV of €900. For the convenience of visitors, you can connect service messages to inform them that their passes are expiring or there are favorable promotions at the gym.

This formula has fewer errors and makes it possible to calculate the indicator for various periods.

Option 3. A challenging one

Our boxing gym has become extremely popular, and people specifically go there from other parts of the city. It is the best time to expand. Let us calculate whether it is profitable. We will use a formula to forecast profitability.

This formula has two more metrics:

- AOV standing for Average Order Value. It is calculated by dividing the profit by the number of sales.

- RPR standing for Repeat Purchase Rate. In order to calculate this indicator, we need to divide the number of customers who bought the services of our gym more than once by the total number of visitors.

Let us calculate. The average bill in the gym has become €250, 45% of athletes repeat purchases, and we are going to calculate LTV for the next three years. After multiplying all indicators, we receive €337 (250 × 3 × 0.45).

This method is great for forecasting. You cannot say whether a customer is going to cooperate with you for three years or how the average bill is going to change, but the data obtained can be used as a reference point for development. In order to successfully process leads and respond in timely manner, chatbots will be beneficial to the Mair network of boxing gyms. They will help athletes see the current schedule, select training options depending on the fighter level, and answer frequently asked questions.

Option 4. Cohort analysis

When our gym just opened, it was convenient to calculate LTV per visitor. But after several years of work, there are more customers and branches, and the per-boxer indicator is not so representative. Cohort analysis will come to the rescue.

A cohort is a group of visitors with similar characteristics. They made purchases in the same period, therefore we can combine them and calculate their common indicator.

For example, let us create a cohort of customers who joined us in January. Let there be 30 of them, people who decided to start a new life with the new year. And let there be another group of those who signed up in April to actively prepare for summer. There will be 40 of them. Now we will calculate ARPU for each group by dividing the total monthly income from all boxers in the cohort by the number of people.

| Cohort | January | February | March | April | May | June |

| January cohort | 150 | 150 | 127 | 119 | 150 | 75 |

| April cohort |

|

|

| 150 | 150 | 150 |

We have calculated APRU for each month. The March and April indicators are lower since some cohort athletes did not attend the gym or pay for training. And all you need to do to obtain LTV is to add up the metrics for the desired period. To sum up:

- January cohort LTV: €771.

- April cohort LTV: €450.

The advantage of cohort analysis is that it helps identify the most profitable customers, marketing efficiency, and seasonal cycles of consumer inflow and outflow, while forecasting financial performance for a month, six months, or a year ahead.

Option 5. Bonus (with an integral)

The owner of our gym decided to level up his entrepreneurial skills and entered the Graduate School of Business. Among many useful things, he was taught how to calculate LTV smarter.

We need to draw up a graph of retention rate, specifically customer retention rate. This indicator shows whether a company is good at building long-term relationships with customers and for how long they are ready to use the services.

A typical retention rate graph looks like this:

Now, in order to calculate LTV, all you have to do is to take the integral of the figure under the curve and multiply it by APRU.

But since we are in a boxing gym and not in a math class, we will use clearer methods.

How to enhance LTV?

Low LTV values indicate that customers are not ready to build long-term relationships with the business. It can lead to huge losses in future. Research shows that it is 4–10 times more expensive to attract a new customer than to retain one, depending on the area of business. In addition, a dissatisfied customer will spread anti-advertising through the grapevine.

There may be various reasons for leaving, but they are generally related to the human factor. It can be poor service, slow support, or failed communication. All these make users turn to competitors.

In order to increase LTV, you need to do the following:

- Work on strong and positive relationships with customers. To do this, inner working is required so that each employee understands and shares the goals, mission, and objectives of the business. A brand tone of voice that can increase user loyalty and help employees build adequate communication with customers will be an advantage.

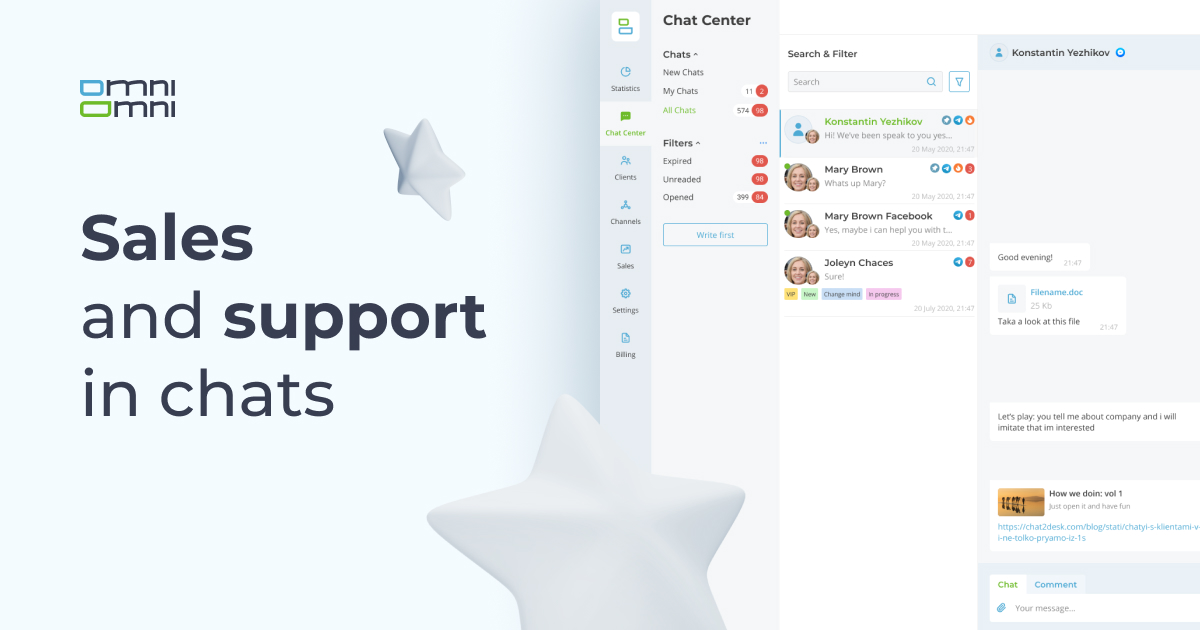

- Timely resolve customer issues. People are ready to continue using brand’s services if their problems are solved, and they have received a proper apology for the mistake. A strong support is required to retain customers and help sell them new services. OmniOmni provides software that can help you build a strong support.

- Build omnichannel strategies. Every customer prefers a certain communication channel, e.g., messengers, phone calls, or email. OmniOmni makes it possible to connect various communication channels and manage them conveniently in a single-window mode. This is an important step to omnichannel.

- Be online 24/7. When someone has a problem, they want a quick and guaranteed solution at any time. Most problems are similar. OmniOmni chatbots will help you promptly deal with them. They are always online and can cope with any number of requests. And in order to solve complex problems, there is a mobile application so you can always be in touch with customers.

- Collect feedback. It is important to collect customers’ opinions on their interaction with the company after every contact. OmniOmni has a Quality Survey option. It will help you monitor the quality of communication with customers and collect feedback.

Now you know what LTV is, how essential it is, and how to calculate it correctly. You will need well-built communication and a customer retention strategy to enhance it. OmniOmni has a proven set of tools that can successfully solve these tasks.